Definition: A trend can be defined

as the general direction of a market or of the price of an asset. Technical analysis is built on the assumption that

prices trend. Trend Lines are an important tool in technical analysis for both

trend identification and confirmation. A trend line is a straight line that

connects two or more price points and then extends into the future to act as a

line of support or resistance. Many of the principles applicable to support and

resistance levels can be applied to trend lines as well. As a general strategy,

it is to best to trade with trends, meaning that if the general trend of the

market is headed up, you should be very cautious about taking any positions

that rely on the trend going in the opposite direction.

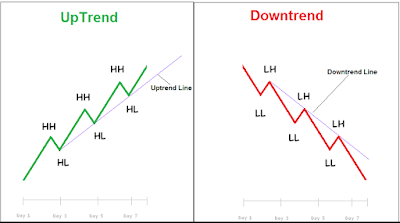

Types of Trends: In technical analysis,

it is the movement of the highs and lows that constitutes a trend. Basically

trend can be defined in two ways one is uptrend and downtrend, and sideways trend

are also include in trend.

Uptrend-Line: An uptrend is

classified as a series of higher highs and higher lows and an uptrend line has a positive slope and

is formed by connecting two or more low points. The second low must be higher than the first for the line to

have a positive slope. Uptrend lines act as support and indicate that

net-demand is increasing even as the price rises. A rising price combined with

increasing demand is very bullish, and shows a strong determination on the part

of the buyers. As long as prices remain above the trend line, the uptrend is

considered solid and intact.

Downtrend-Line: A downtrend is classified as a series

of lower lows and lower highs. It describes the price movement of a financial asset

when the overall direction is downtrend. A downtrend line has a negative slope

and is formed by connecting two or more high points. The second high

must be lower than the first for the line to have a negative slope. Downtrend

lines act as resistance, and indicate that net-supply is increasing even as the

price declines. A declining price combined with increasing supply is very

bearish, and shows the strong resolve of the sellers. As long as prices remain

below the downtrend line, the downtrend is solid and intact.

Sideways Trend: Sideways trend also

know as horizontal trend or consolidation, describe the horizontal price

movement that occurs when the forces of supply and demand are nearly equal. A

sideways trend is often regarded as a period of consolidation before in the

price continues in the direction of the previous move. It is classified as a series

of horizontal peaks and horizontal troughs. You can heard about a word call

range bound, this phase where market moving or trading in range.

Note: More about trend lines will be on next post please like, if it's useful to you,Thank you.

Comments

Post a Comment